vermont income tax withholding

W-4VT Employees Withholding Allowance Certificate. Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding.

Irs Installment Agreement Wheatfield In Mm Financial Consulting Inc Irs Payment Plan Business Plan Template Free How To Plan

Tax Rates and Charts Tue 12212021 - 1200.

. An Official Vermont Government Website. If Federal exemptions were used and there are additional withholdings proceed to step 8. FS-1278 - Self-Employment Income Taxation.

If you have any questions about the process call the agency directly at 802 828-6802 or send an email to taxbusinessvermontgov. Apply the taxable income computed in step 5 to the following table to determine the annual Vermont tax withholding. In Vermont there are three main payment schedules for withholding taxes.

The income tax withholding for the State of Vermont includes the following changes. It should take one to three weeks for your refund check to be processed after your income tax return is recieved. Find your pretax deductions including 401K flexible account contributions.

The more you withhold the more frequently youll need to make withholding tax payments. If you pay wages or make payments to Vermont income. The Single Head of Household and Married annual income tax withholding tables have changed.

Vermont has no cities that levy a local income tax. 2015 Income Tax Withholding Instructions Tables and Charts. The filing status number of withholding allowances and any extra withholding for each pay period is determined from the employees Form W-4VT Employees Withholding Allowance Certificate.

DOWNLOAD NOW Author. The Single or Head of Household and Married income tax withholding tables have changed. Vermont School District Codes.

The annual amount per exemption has increased from 4250 to 4350. March 17 2017 Effective. IN-111 Vermont Income Tax Return.

Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding. Reporting and Remitting Vermont Income Tax Withheld. The withholding is based on both the deferred payment and any income that may be derived from the deferred compensation.

PA-1 Special Power of Attorney. Tax Rates and Charts Tuesday December 21 2021 - 1200. No action on the part of the employee or the personnel office is necessary.

IN-111 Vermont Income Tax Return. 2022 Income Tax Withholding Instructions Tables and Charts. Find your gross income.

If additional Federal tax was withheld multiply the additional amount by 26 percent and add that to the result of step 7 to obtain the biweekly Vermont tax withholding. Before sharing sensitive information make sure youre on a state government site. 2022 Income Tax Withholding Instructions Tables and Charts.

The amount of each annual withholding allowance for 2019 is 4250. If Federal exemptions were used and there are additional Federal withholdings proceed to step 8. TAXES 17-13 Vermont State Income Tax Withholding.

For wages paid on and after January 1 2019 married person including civil. PA-1 Special Power of Attorney. Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding.

If Federal exemptions were used and there are additional withholdings proceed to step 8. The Single Head of Household and Married tax tables has changed. Your payment schedule ultimately will depend on the average amount you withhhold from employee wages over time.

If youre a single filer with 40350 or below in annual taxable income youll pay the lowest state income tax rate in Vermont at 335. The extension applies to returns and payments for personal income tax withholding corporate and personal income tax returns. Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding.

No action on the part of the employee or the personnel office is necessary. Semiweekly monthly or quarterly. The Vermont Income Tax Withholding is computed in the same manner as federal withholding tax by using the Vermont withholding tables or wage bracket charts.

Vermont School District Codes. If additional Federal tax was withheld multiply the additional amount by 26 percent and add that to the result of step 7 to obtain the biweekly Vermont tax withholding. The annual amount per exemption has increased from 4050 to 4250.

The Single and Married income tax withholdings will increase for the State of Vermont as a result of changes to the formula for tax year 2017. If Federal exemptions were used and there are additional withholdings proceed to step 8. No action on the part of the employee or the personnel office is necessary.

The income tax withholding formula on supplemental wages for the State of Vermont includes the following changes. The gov means its official. Your Vermont withholding account number should start with WHT and either a 10 or a 11.

If your state tax witholdings are greater then the amount of income tax you owe the state of Vermont you will receive an income tax refund check from the government to make up the difference. VERMONT 89-100 RETURN FILING AND PAYMENT OF TAX 89-102 Returns and Payments in General. State government websites often end in gov or mil.

CCH State Tax Law Editors. Tax Rates and Charts File. Business Economics.

Plan the correct withholding rate is 6 of the deferred payment. Find your income exemptions. Complete the remaining questionsfields.

If additional Federal tax was withheld multiply the additional amount by 26 percent and add that to the result of step 7 to obtain the biweekly Vermont tax withholding. If Federal exemptions were used and there are additional Federal withholdings proceed to step 8. This means that whether you live in Burlington Rutland or anywhere in between you wont have an additional local withholding.

You should receive your account number in 5-7 days. The annual amount per allowance has changed from 4350 to 4400. Check the 2019 Vermont state tax rate and the rules to calculate state income tax.

Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding. The income tax withholding for the State of Vermont includes the following changes. Vermont 2019 annual percentage method withholding For wages paid on and after January 1 2019 single person Note.

If Federal exemptions were used and additional Federal tax was withheld multiply the additional amount by 27 percent and add that to the result of. How to Calculate 2019 Vermont State Income Tax by Using State Income Tax Table. 2015-Withholding-Instructions-Charts-Tablespdf 43334 KB File Format.

W-4VT Employees Withholding Allowance Certificate. 5 rows The income tax withholding for the State of Vermont includes the following changes. Pay Period 06 2017.

State W 4 Form Detailed Withholding Forms By State Chart

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

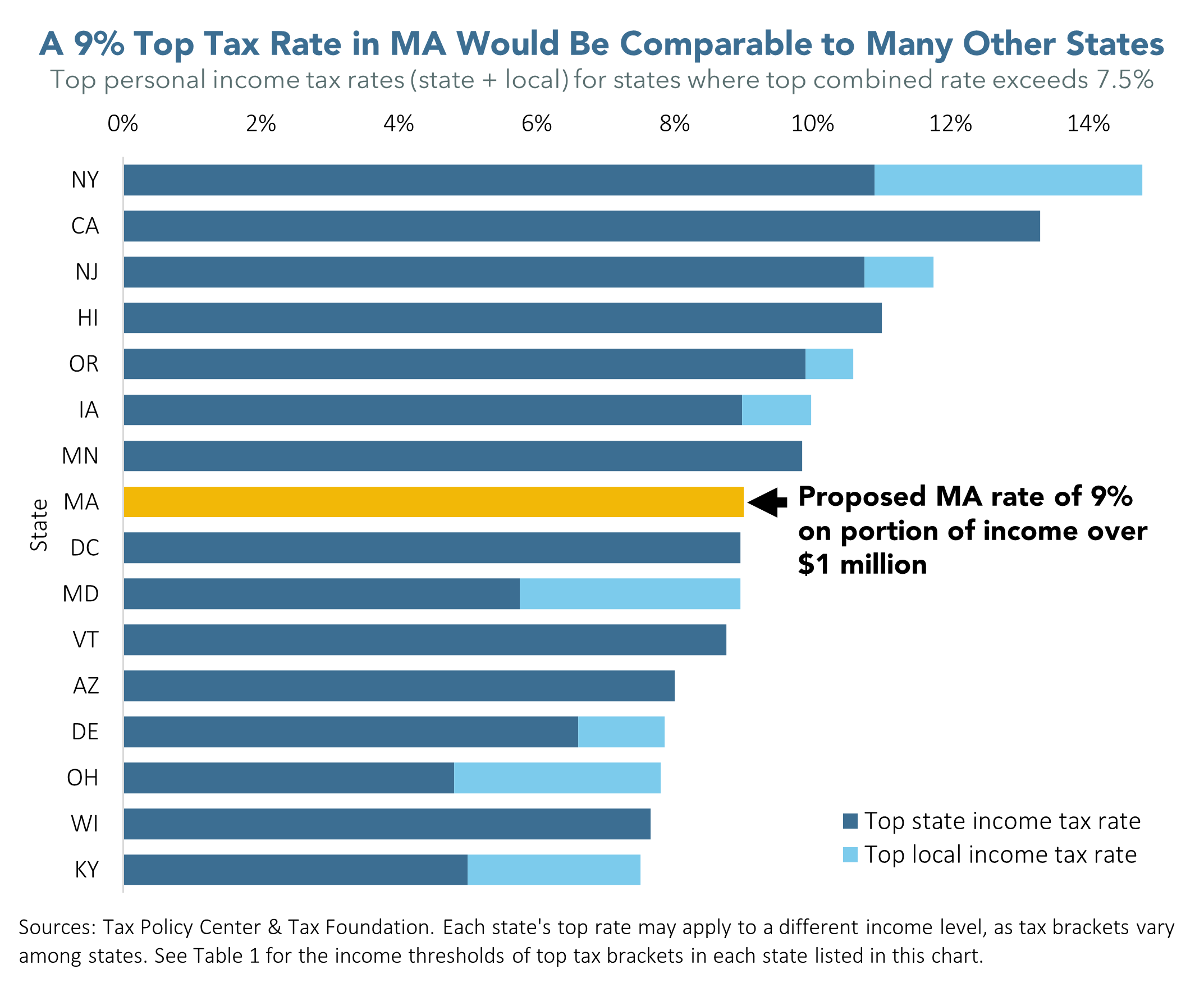

With Millionaire Tax Massachusetts Top Tax Rate Would Compare Well To Top Rates In Other States Mass Budget And Policy Center

State Income Tax Rates Highest Lowest 2021 Changes

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

How Can You Save Money On Income Taxes This Year The Wake Up For Wednesday Jan 12 2022 Cleveland Com

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Paycheck Taxes Federal State Local Withholding H R Block

How Is Tax Liability Calculated Common Tax Questions Answered

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Colorado Income Tax Rate And Brackets 2019

Strength In Personal Income Leads Tax Revenue Results Vermont Business Magazine

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Trump S Proposed Payroll Tax Elimination Itep

How Is Tax Liability Calculated Common Tax Questions Answered

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)